Franco Gussalli Beretta, born in 1964, together with his older brother Pietro represents the 15th generation of the oldest industrial family in the world. He is currently president and CEO of Fabbrica d'Armi Beretta (Beretta Arms Factory), as well as president-designate of Confindustria Brescia for the four-year term 2021-2025. We interviewed Mr. Beretta starting with the company's latest success, namely the acquisition of RUAG Ammotec.

As of the end of July 2022, Beretta Group is the new owner of RUAG Ammotec. Congratulations. It sounds like something very special, particularly at this magnitude. What are your expectations, plans and overall vision after the acquisition of RUAG Ammotec?

As in all these things, there is something you plan to do and something that is in the making, because in general an acquisition is a complex project. The acquisition of RUAG Ammotec is very complex, given the size of the group and the number of manufacturing plants. In principle, we plan to follow the logic that we have always followed with acquisitions; therefore, actually leave a certain brand independence and identity and know-how, either of the company or of the acquired group, which therefore will not be linked to the Beretta theme but will be part of Beretta Holding. The ammunition theme however will be emphasized even more so at the moment we are thinking of calling this division Ammotec. Each manufacturing company in the group is taking the name of the main brand, in Sweden Norma will in fact remain Norma Precision AB. So, the group will be called Ammotec and in Sweden the plant and the company will be called Norma. This brand will also have a U.S. establishment, so there will be a second company that under local regulations will be called Norma Precision Inc. This is because the Norma brand is believed to be the leader, at least currently, in the American market distribution.

The main plant – RWS – is located in Germany, in Hungary there is MFS Defense ZRT, and finally the Swiss portion will be called Swiss P Defense AG. We want to give consistency to what we have always done and said, that is that every company acquired has its own strong identity that must be maintained, with the important brands and know-how it carries with it.

How does Sako brand fit into this strategy?

We would like to preserve its identity, as we have maintained it until now. Since its origins, Sako has been manufacturing both firearms and ammunition, I think it is always a great asset to have within the group a brand that has these two branches, something that Beretta, Benelli, RWS and Norma do not have, because they are identified as either firearms or ammunition manufacturers. Sako is our only brand that offers this dual aspect. Or rather, it is not the only one in absolute, but it is the one that actually already manufactures rifles and ammunition. In reality, there is also Holland & Holland, where the project is much more complex because we absolutely want to keep the strong English identity of the brand (which is the reason we acquired it); as far as firearms are concerned, it is clear that they are and will be 100% produced in the London factory and we are reinvesting to have the products and the shop upgraded. The shooting range is also a big asset. What we are analyzing is the famous Holland & Holland ammunition’s heritage and soon we will have to decide on the right strategy.

Back to Sako, I believe in this strength of the firearm/ammunition combination that I have invested in over the last few years. Fortunately, both the ammunition part and the gun part, which is what we have been investing in the longest, are doing very well. Both of them have a manufacturing capacity problem, so much so that unfortunately we are always late with deliveries. So, for the firearms division, it is clear that investments will be continuous, constant. For ammunition, I definitely want to maintain that identity. However, it may be that there will be synergies, for example in the field of primers, where it is clear that we will have to deal with our new cousins in RWS, who are leaders in this field. So, the primer business can be a first meeting point, but we know that in the world of ammunition there is also the whole issue of bullets. Sako manufactures some bullets in-house, but buys others from other specialists; so, some collaboration could come from that direction as well. Ultimately, Sako has given us great satisfaction and I am sure it will continue to do so.

Sako has an interesting brand strategy with firearms and ammunition under one brand. SIG Sauer USA is also following this concept whereby the entire system (rifle, conventional and electronic optics, ammunition) come under one brand. Could this be a master plan for Beretta in the future?

It's hard to say, it's not in the plans at the moment because our philosophy, at this point I think it's clear, is to make the acquisitions to have within the group the know-how for optics and ammunition, but to keep the great asset that is the identity of these companies that we buy, not putting the Beretta brand on it but leaving and developing the original one. We did it for Burris and Steiner and now we will do it with RWS, Norma and so on.

What are the main growth potentials after the acquisition of RUAG Ammotec? Where do you see the key markets, in the military / law enforcement segment or in the civilian segment? In Europe or in the U.S.?

There are so many opportunities, and I am an optimist. To go back to ammunition, Beretta knows the market, but it definitely knows the firearm, clothing and accessory market better. Now we see great potential in both sectors, civilian and military, because Ammotec has great expertise in both of these fields. We, as a business strategy, think that the military sector is very important from the research and development point of view, but we also think that for an industrial and family business like ours the civilian part is the most stable and the one that suits us the best; so we will still invest a lot in this sector where we know that the Ammotec group is already very strong in Europe, then we will have to analyze the situation to decide whether to make further efforts to strengthen it further. If we add to this the fact that Sako in the Nordic countries already has leadership in the civilian rifle sector, similarly to Beretta and Benelli for semiautomatic shotguns where we are already well positioned, certainly the eyes go in that direction.

We think America offers great possibilities for expansion, despite all the difficulties there. In recent years some companies, such as Norma Precision Inc. have had incredible growth in the U.S., certainly helped by the market spike, and they have done a very important penetration job. However, we know that the North American market is the biggest but also the most competitive, so we will have to define the right strategy. On the board of Norma USA, I wanted two very important figures from the ammunition world because they are the two people who, together with the local team, have to help us understand how much space a big European manufacturer can find in America. We know that the space is huge, and we have to see how right it is for a big European manufacturer to have the ambition to occupy it. So, in Europe the civilian market is definitely important, and we will try to maintain the positions or improve and complement them with Sako. On the other hand, America is an impressive market, but we are fully aware that Winchester, Federal and Hornady are not going to wait for us to eat a part of the market....

From a potential development point of view, I think the United States can give us satisfaction, we just have to be well organized. Let's talk about the two people we put on the board of Norma, U.S. The first is Carlo Fiocchi, with whom I have a 30-year friendship now. Fiocchi was already our consultant for the Sako ammunition part, and now he will help us with his experience to understand how to develop and improve a strategy by having an even more complete product range. The other person is Mr. Mark DeYoung, who was the head of the ammunition giant ATK. They both have just been appointed and we have already had an initial meeting and now we leave it to the team that has already achieved great results. I have a 360-degree knowledge of the market, but Carlo and Mark are specialists and will certainly bring a lot to the table. So maybe in a year's time we will have a clearer view of the market.

On the military side, there is the whole sensitive issue of regulations, as each of these plants is subject to the laws and regulations of its own country: RWS to Germany, Norma to Sweden, and Swiss P to Switzerland. We think there are very good opportunities, and it is a market where we need to develop. We can say that the civilian market is always important to Beretta because it is the one that gives us stability, while the military is the one that pushes us to innovate.

Innovation also means using new materials and new technologies, and today especially we are talking about energy saving...

I have already had a meeting about materials because in a product like ammunition, regulatory changes on the one hand and the cost of raw materials and energy on the other must be carefully analyzed. You must stay competitive by following regulations, so the commercial potential will also depend on what paths we take toward materials that have already been studied or are going to be studied. Certainly, there are changes on the horizon; I'm not saying they will be epochal like the automotive world going from endothermic to electric or hydrogen, but when regulations come into play, you must be careful about it, otherwise you risk going out of the market. When it comes to materials, so many studies and so many patents have already been filed by RWS, so as usual if you look at the glass half empty you'll obviously think "they're taking the seat out from under me and I risk falling off..." but on the other hand, if you have the right vision and make the right investments, it can be the big opportunity for growth because you're more ready than others to be able to grasp these changes. Markets, you know, are also made of this.

Ammotec is not only an ammunition manufacturer with five plants in five countries (Germany, Switzerland, Hungary, Sweden and the U.S.). The group also has wholesale companies in 16 countries. How does this fit into Beretta's strategy? Isn't it unusual for Beretta to sell competitor products? Will these activities be part of a future strategy? Or will the sales of Beretta and Ammotec be gradually merged?

Certainly, Beretta's core will be the priority, but we already have experience with our own companies, such as GMK that distribute third-party products, that perhaps are not in direct competition, but complementary. In the process of analyzing the assets of this great organization we will evaluate what the best opportunities are, however where we believe to be in our common interest – ours and of the other manufacturer's – I have no problem in distributing products that may be in competition and not ours.

When do you think the "big picture" of a future strategy can be completed? Is it just a matter of quick wins or is there a concrete long-term vision, as we have long seen in the Beretta Group?

We never consider that everything has to be under the Beretta umbrella. If we feel like it could be an opportunity, Beretta will do it, but if, on the other hand, we feel that in order to have better market penetration it's important to keep another company, why not? Therefore, it will be based on these evaluations, which we make from both a holding company point of view – so financially – and from the sales and marketing directors' point of view, that we will figure out what is the right compromise. For us the priority is not to merge, it is to have the best market penetration.

all4shooters.com and our German publisher VS Medien are also now part of the Beretta Group. How does it feel to be a media publisher/owner?

As you already know, at the beginning of my career I was a publisher together with other partners. So, within me there is a inclination to understand that part of the marketing activity of a company like Beretta, can and absolutely must be linked to a media group as well. This is actually not a brand-new experience for the Beretta group either, since within the Sako acquisition there was the Stoeger group that published the Shooter's Bible yearbook in the United States and for a few years continued this activity, which was not under my direct control but was the responsibility of Benelli USA. Then, digital took over, and at that point we felt that we did not have internal capacity to make the U.S. publication leap into a new format. So as a Holding we have already addressed this issue; we consider it absolutely complementary, not easy, however our understanding is again: let's "figure it out", with the advantage that in VS Medien there is the traditional part, with printed magazines, and there is already a digital section that could be used more widely. Again, there is the question of how to find the right balance between being a media division that covers a whole range of products – but in my opinion absolutely must maintain its identity – and its mission to be the interlocutor of so many other companies that naturally operate in the field. These are difficult balances to plan in the abstract, yet they must be found. I think that having a "media culture" again is a great asset for the group, and therefore for Beretta products, but also for the industry: it has always been a bit of our view, since my father's time, that there are a whole series of activities that you have to think about to keep the attention high on an industry that is not huge and definitely needs media activity to stimulate our fans and provide them with content.

In my opinion it is good that the digital part has already started: again it is important to understand how much it can be expanded from a point of view of simple communication, but also for the many other opportunities it offers, therefore in the next few weeks we plan to have discussions with the sales and marketing directors to see how the group can interact, but after that VS Medien must have its own independence having its own mission, know-how and reputation. As far as the digital part is concerned, instead of taking care of it myself, probably it will be followed by my son Carlo, who of course is more inclined than I am, and so he will try to make a contribution as I had done with the clothing and accessories division, with the Magnum magazine, and whatnot, as a young entrepreneur with his own ideas. So, in my opinion it can be a good opportunity for a company like VS Medien, and also a good school for Carlo, a side business but including an important digital part. For his generation I think it's the bread and butter, while for ours it's just part of the job. But the future is there.

Do you see strategic value in supporting media as owners internationally, also ensuring stable and independent journalistic channels in your target groups and having better access to young people?

Definitely yes, then as usual it all depends on the local cultures, and we will have to decide in which countries we want to operate with VS Medien. Because in my opinion there are cultures that are much more predisposed towards the worlds of hunting and shooting sports, so VS Medien has to have a strategy in that sense as well. That is a stimulus that maybe I will give: to analyze whether the markets that are being covered so far are just those or whether there is some opportunity that goes beyond that. But at this point it is clear that the Beretta Group is not focused on one or two markets, it is international. VS Medien already has an international business too, so it probably pays to continue in the direction of internationalization.

How important is digital media in engaging young people?

The issue of young people is very important, particularly in a country like America, which in recent years has had an increase in the famous "first-time gun buyers" who are mainly young people and women. Clearly, you have to have a very focused strategy towards educating them about what the world of guns, hunting, shooting and the various sports is. In America we will eventually have to be very careful about the issue of new laws, because we know that our world is always highly regulated. There are states like California where there is a very strong state restriction against gun manufacturer’s certain types of advertisement and media commercials. You have to take into account, in the internationalization project, where young people can be informed and where they cannot, and so we will have to follow these issues. The world is constantly changing, though, and getting in touch with young people is a goal of ours.

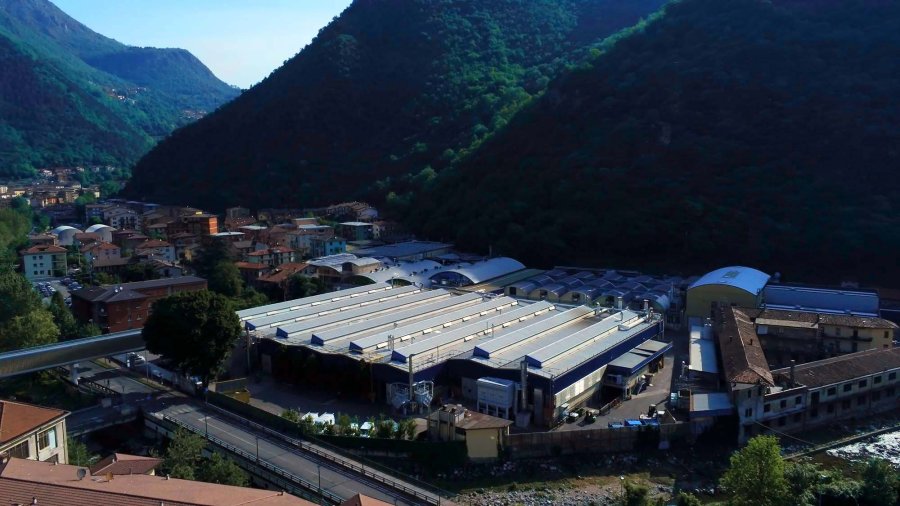

The interview was conducted by Giorgio Brancaglion on October 11, 2022 at the Beretta headquarters in Gardone Val Trompia, Brescia, Italy.

Yesterday we received the information that Beretta Holding S.A. will invest another $60 million in a new production and distribution facility for Norma Inc. in Savannah, Giorgia. Dr. Pietro Gussalli Beretta (President and CEO of Beretta Holding S.A.) signed a moratorium to this effect in the USA on November 10.